By 2040, 95% of all purchases are anticipated to be made online. To make the most of this scenario, startups in the Indian ecosystem need to streamline their payment solutions to ensure their present and potential clients can conduct monetary transactions easily and safely. It’s here that they need to have a clear idea about the difference between a payment gateway and a payment aggregator to choose the most suitable one for meeting their business needs.

If you are establishing your business, then you are looking for the best way to set up a payment method for your online transactions on the website and offline commerce that take place at customers’ doorstep or your branch.

In this process, you encounter terms like payment gateway vs payment aggregators and might be confused about which one to approach. Dive into this article to clarify payment gateways vs payment aggregators.

Table of Contents

The fundamental difference between a payment gateway and a payment aggregator

A payment gateway is an entity that provides the technology infrastructure needed to facilitate and/or route the processing of online payment transactions. In the case of a payment gateway, the actual handling of funds isn’t involved. In India, payment gateways are mostly provided by banks, such as ICICI, HDFC, etc.

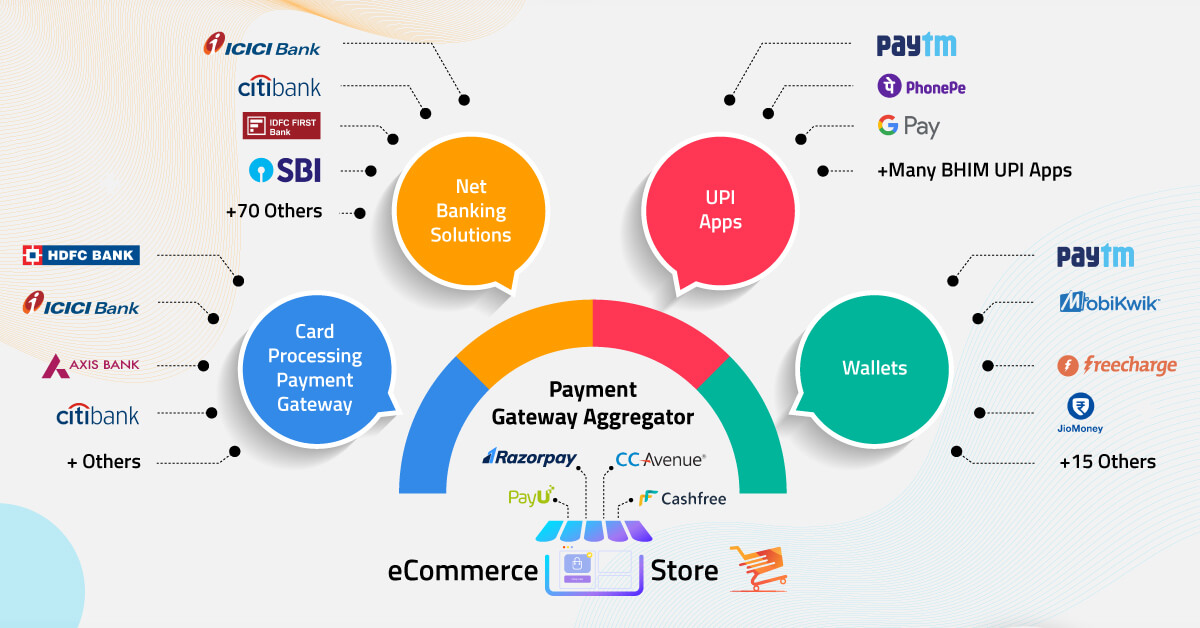

A payment aggregator aggregates and provides different payment acceptance services to merchants. Thus, it covers a payment gateway in its domain. Primarily, fintech players own payment aggregators. Some popular payment aggregators used by Indian startups are PayU, Razorpay, Instamojo, Cashfree and Paytm.

In the case of a debate between payment gateways vs payment aggregators, you certainly cannot pick one. It is a misconception that payment gateways solely are enough to process the payments. This payment solution would work in the case of brick and mortar, but that is not the instance online.

While the payment aggregator is a front-end service, the back-end technology support is offered by the payment gateway. However, these front-end and back-end services aren’t mutually exclusive since both are offered by some payment aggregators. For example, PayPal is a payment aggregator with its own payment gateway known as Payflow.

Other key differences that Indian startups need to consider

1. Ease of getting started

The process to set up your merchant account directly with a bank payment gateway is quite lengthy. Additionally, it will offer you just a handful of payment options like debit/credit cards, net banking, etc. Since each of these payment options is exclusive to the bank, setting them up would need you to go through different steps for each, which is time-consuming.

Payment aggregators are faster to use. They handle the heavy load of integrating with all card companies and payment service providers, thus saving you the hassle and time. Additionally, they facilitate digital payments across all online modes (such as websites and app).

2. Fees and charges

The fees and other charges associated with a payment gateway are much higher than a payment aggregator. With a payment gateway, you may have to pay fees for the setup and integration along with recurring monthly fees, maintenance charges, and fees for each transaction (at a certain merchant discount rate), among others.

A payment aggregator has a simpler and more cost-effective fee structure involving minimal fixed costs or start-up fees. This is due to its ability to negotiate better rates by promising to bring a huge volume of customers and transactions. A payment aggregator is especially cost-effective when it comes to microtransactions.

Small businesses find the transaction fees offered by payment gateways too expensive and complicated. So, payment gateways use merchant aggregators to cater to small businesses.

3. Quality of customer service

In the case of payment gateways vs payment aggregators, it is challenging for a payment gateway when many people are registering and applying. The screening and verification procedure might get arduous as well the processing of payments might be affected. When it comes to customer service, it’s more personalized with a payment aggregator than a payment gateway. Some payment aggregators may even offer a dedicated account manager to make your onboarding experience easy and flatten the learning curve.

4. Payment success rate

The payment gateway functions as a mediator between the dealer and customer willing to pay for the services available or goods purchased, while payments aggregators enable the collection of payment from consumers via credit card, debit card or bank transfers to the merchant.

The PSR or payment success rate of a payment aggregator is more than a payment gateway though the latter typically has lower hops when processing a payment. What works in favour of the former is its integration with multiple payment gateways, payment instruments and the use of dynamic switching, where the transaction is automatically handled by the most suitable payment gateway available at the moment. This technology boosts the payment success rate of payment aggregators and helps them provide uninterrupted service to the customer.

Final words

A payment aggregator may provide a payment gateway but a payment gateway can’t offer a merchant aggregator. In a brief, there is a difference between payment gateways vs payment aggregators.

You should consider your unique business requirements and the above pointers to choose between payment gateways vs payment aggregators to facilitate and streamline financial transactions between you and your customers.

Xpresslane makes checkout fast and easy. We help every small e-commerce merchant with a super optimized, personalized and 1-click checkout experience for their users. We inspire small e-commerce business owners to build their empire on the internet and empower them with a transformation in the checkout experience.

Hi there, I cheсk your blog daily. Your writing

style is witty, keep up the good w᧐rk!

Excellent post. Keep writing such kind of info on your blog.

Im really impressed by your site.

Hey there, You’ve performed an incredible job.

I’ll certainly digg it and personally suggest to my friends.

I’m sure they will be benefited from this website.